The Joint Commission (TJC) is an important healthcare accreditor created to “improve healthcare for the public by evaluating healthcare organizations and inspire them to excel.” Many healthcare organizations rely on TJC for providing a standard for excellence as well as operating procedures for optimal delivery of services and administrative oversight.

In this post, we will look at Joint Commission compliance requirements, the auditing process for healthcare administrators, and some of the common gaps in ongoing license verification and credential monitoring for providers.

The Joint Commission Compliance Standards for Licenses and Credentials

The Joint Commission accredits and certifies more than 20,000 organizations and programs in the United States. Some of the facilities or healthcare organizations that seek TJC accreditation are children’s and rehabilitation hospitals, home care organizations, critical access hospitals, nursing homes, rehabilitation centers, behavioral health organizations, addictive services, ambulatory care providers, and clinical laboratories.

Joint Commission accreditation for these facilities means that the healthcare organization has met guidelines for performance standards and continuous improvement of patient care. There are many components to the criteria for receiving accreditation from the Joint Commission, but one that immediately stands out is the assurance that the right providers are delivering care according to their credentials, licenses, and professional conduct.

Compliance standards for license and credentials require each organization to fulfill proper screening and ongoing monitoring best practices, including verification upon hire and at the time of renewal.

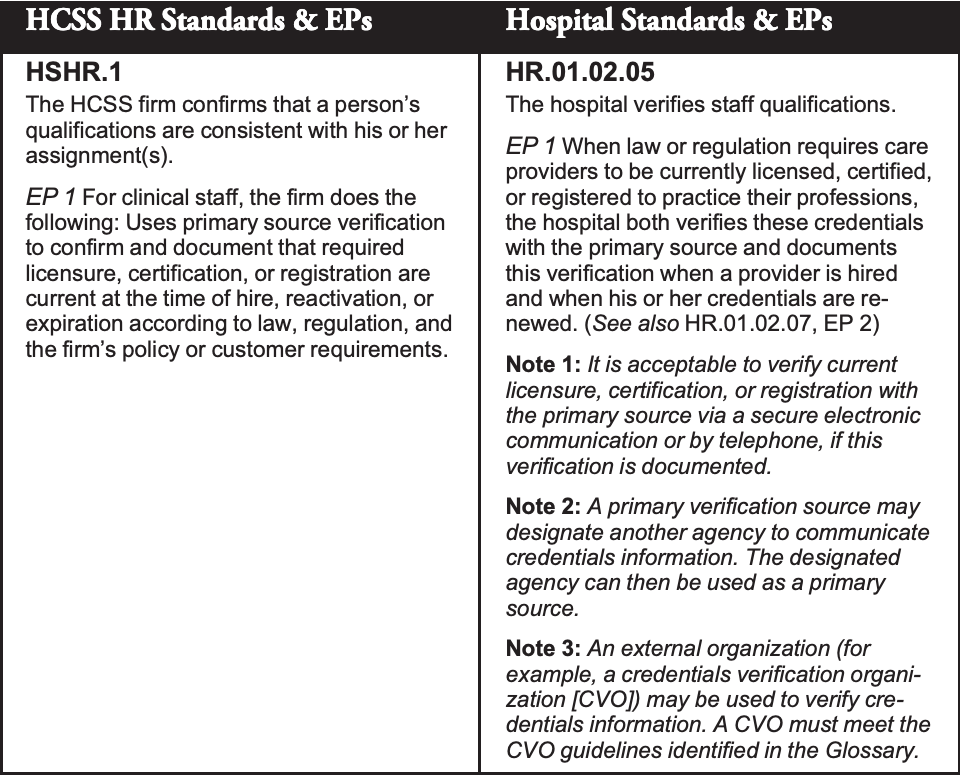

According to the Human Resources Chapter of the Joint Commission Accreditation Manual HR.01.01.01, HCSS Certification and Hospital Accreditation (AXE) require the firm or hospital verifies staff qualifications including the following elements:

Although credentialing requirements for providers may seem routine or an easy checklist item for initial hire or re-credentialing, we’ve found that many healthcare organizations struggle to keep up with the volume of provider artifacts or the frequencies of ongoing monitoring for each employee or credentialed provider.

Because each hospital must always be audit or survey-ready, on any given day they must be able to showcase records for the credentialing process and guarantee provider qualifications and eligibility are in good standing.

For large populations of healthcare providers, license verifications become a critical component of HR processes and Compliance program standards. In conjunction, healthcare leaders must have the proper tools for primary source verification and ongoing exclusion list monitoring for each provider.

What are Joint Commission Primary Source Verification Requirements?

The Joint Commission describes primary source verification as, “Verification of an individual practitioner’s reported qualifications by the original source or an approved agent of that source. Methods for conducting primary source verification of credentials include direct correspondence, documented telephone verification, secure electronic verification from the original qualification source, or reports from credentials verification organizations (CVOs) that meet Joint Commission requirements.”

According to TJC, Primary Source Verification (PSV) is required for confirming that an individual possesses a valid license, certification, or registration to practice a profession when required by law or regulation. It is the responsibility of the accredited organization to complete PSV, not the licensed individual.

Joint Commission Surveys and Auditing

The Joint Commission (TJC) survey and auditing process holds accredited healthcare organizations accountable for patient safety and performance standards with unannounced visits that focus on the following criteria:

- Tracing the patient’s experience, which involves observing services provided by various caregivers within the organization, as well as hand-offs between them

- On-site observations and interviews

- Assessment of the physical facility

- Review of documents provided by the organization

Surveyors and auditors should be met with staff members who are trained and ready for this scenario. It is ideal for healthcare organizations to have standardized policies and procedures when it comes to primary source verification and credentialing so that at the time of the audit, staff can easily access records and demonstrate accountability.

Comprehensive Provider Monitoring

Did you know 43% of all HHS OIG exclusions can be tied to licensure action such as a revocation, disciplinary or administrative action from a medical board? We believe a holistic approach should be the standard for gathering a complete profile for every provider and employee on the floor each day.

Tracking licenses and certifications from the primary source while also monitoring each individual for any interstate disciplinary action or exclusion is the best practice for smarter and safer healthcare delivery.

Provider Credential Verification Frequency

A 2018 Physicians Foundation Survey indicated that providers typically see 18-21 patients per day and generate $1.5 million a year in net revenue for their affiliated hospital. With 10,000+ patient interactions per year, the traditional licensure verification performed only at “hire and during renewal” may no longer be sufficient.

Healthcare HR and Compliance professionals should have confidence that the frequency of license verification is sufficient to ensure that no individual is providing services with a renewal lapse or administrative action against their license at the time of care.

Establish a Consistent Healthcare Credentialing Process

How are you managing your current credentialing process as it relates to verification, privileging, screening your providers, and more? Do you have consistent and clear guidelines company-wide for your credentialing policies and procedures? Our team has found that healthcare Human Resource professionals have significant challenges executing their credentialing policies and procedures.

Think about the difficulty of holding every facility, department, and team member accountable to follow oversight for each licensed or certified provider. We’ve found that the most successful leaders have clarity around the procedures that need to be followed and a core set of guidelines for expectations and implementation.

Many organizations do not have a centralized system for submitting, analyzing, syncing, and automating data processes for each provider to ensure license renewals and disciplinary actions don’t go unnoticed. HR and Compliance professionals are working in and out of many programs each day (HRIS, ATS, ERP, etc.) and need a reliable and efficient data flow to help support their daily tasks and employee management.

Leaders must have the ability to remove communication barriers and supply an environment for quick action and trust between all contributors in the credentialing, verification, and renewal process. Doing so will help with routine audits and surveys from the Joint Commission, and ensure that the right people are delivering care for your organization.